Between 2024 and 2026, Pakistan’s steel industry has shown signs of structural change. After years of capacity underutilization, a mix of government policy moves, large infrastructure projects (notably the renewed push for CPEC Phase-II), private investment, and shifts in global trade flows has combined to create both near-term demand spikes and medium-term growth opportunities for local producers.

Table of Contents

Toggle1. Quick Snapshot: Production, Imports, and Market Structure

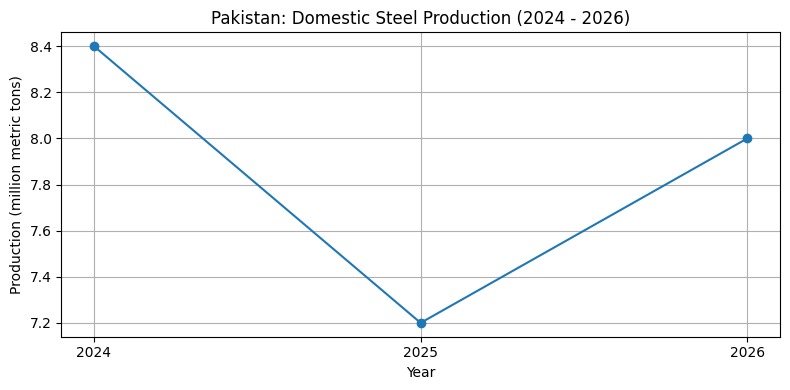

Domestic steel production has been volatile: various sources point to domestic output of around 8.4 million tonnes in 2024, a dip to ~7.2 million tonnes in FY2025, and expectations of recovery into 2026 as reconstruction and new projects pick up — the 2026 point in our graph is a projection based on policy and project pipelines described below. Imports of finished steel and scrap also shifted — imports rose in some periods as local producers adjusted feedstock mixes. Privatization Holding Company

Primary Drivers Behind Growth (2024–2026)

Mega Infrastructure and CPEC Phase-II

Renewed momentum in CPEC Phase-II and related infrastructure agreements signed during 2024–2025 (and additional Chinese investment commitments) are major demand drivers for steel — highways, power plants, industrial parks, ports, and energy-sector projects all consume large volumes of long, flat steel. These projects drive immediate demand for rebar, structural sections, and coated/flat products. CPEC

Post-flood Reconstruction and Housing Programs

Natural disaster recovery (floods) and government housing initiatives create concentrated demand for construction steel (rebar and structural steel). Reconstruction spending tends to be steel-intensive, which helps explain part of the expected FY25–FY26 demand rebound.

Policy Support: Import Substitution & Industrial Policy Moves

Pakistan’s authorities have signaled and, in some cases, implemented measures to protect/incentivize local production: tariffs and anti-dumping duties, discussions of a formal steel policy, and targeted incentives for local mills and downstream fabricators. These policy tools reduce import competition at times and encourage local investment. Profit

Private Investment, Mill Modernization, and Downstream Expansion

Local steel producers have been upgrading rolling mills, adding capacity in long-steel segments, and improving quality (to supply automotive, appliances, and engineering sectors). Where modern mills replace older, less efficient capacity, unit costs fall and product quality rises — enabling substitution for some imported products. Reports note private expansion plans and interest from foreign partners. Backup SQL Visualizer

Global Trade Flows & Raw Material Dynamics

Global rebalancing (e.g., lower Chinese export pressure and shifting scrap flows) combined with temporary commodity price stabilization provided local suppliers with room to recover volumes and margins in 2024–2026. At the same time, scrap availability and price volatility remain important constraints. PACRA

Technology, Quality & Environment – The Hidden Growth Levers

- Mill modernization (direct-reduced iron, better induction furnaces, modern rolling lines) is improving product consistency and reducing energy intensity in some Pakistani mills.

- Adopting quality standards helps local mills qualify for export or supply contracts (e.g., in the automotive or electrical equipment sectors).

- Energy efficiency and waste-heat recovery can materially lower production costs in a high-energy-cost environment.

Economic & Social Impacts

- Employment: expansion in mills, downstream fabrication, and logistics creates direct and indirect jobs across regions with steel clusters.

- Value chain development: growth stimulates demand for value-added products (cold-rolled coils, coated steel, pipe fittings), supporting SMEs and exporters.

- Macroeconomic benefits: reduced import bills for finished steel and increased local manufacturing help improve the industrial GDP share over time.

Key Challenges that Could Slow Growth

- Energy costs & power reliability: high energy bills and outages raise production costs and limit run hours for electric-arc furnaces. Pakistan Stock Exchange

- Raw material & scrap availability: Reliance on imported scrap or hot-rolled coils can squeeze margins when global prices spike. PACRA

- Regulatory/tax distortions and tariff uncertainty: unpredictable policy can distort investment decisions and trade flows. Capital Development Authority

- Under-utilized capacity & outdated assets: pockets of old capacity (including debates around reviving Pakistan Steel Mills) complicate the picture of “growth” vs. “restructuring.” The Express Tribune

Opportunities & What to Watch (2024–2026)

- Export windows for regionally competitive products (to Afghanistan, Central Asia, and the Middle East) if cost and quality align. 6Wresearch

- Downstream value-addition (pre-coated steel, precision tubing, automotive grades).

- Circular economy & ship-recycling integration as a potential domestic scrap source (policy discussions have started). Arab News

Short, Clear Recommendations for Industry Stakeholders

- Mills: invest in energy efficiency and modern rolling lines; lock long-term scrap supply contracts.

- Government: finalize the national industrial/steel policy, provide predictable tariff frameworks, and support financing for modernization. Profit

- Investors: target downstream and finishing capacities where margins are higher, and import substitution is easier.

- Downstream SMEs: partner with local mills to establish just-in-time supply agreements and reduce working capital.

Conclusion — Why Growth is Likely (But Not Guaranteed)

Between 2024 and 2026, the Pakistani steel industry is poised to grow due to concentrated infrastructure demand (CPEC Phase-II and recovery projects), policy moves favoring local production, private investment, and mill upgrades, and shifts in global trade that reduce cheap import competition. However, energy supply, raw material availability, and policy clarity will determine how deep and sustainable that growth becomes. The 2026 outlook is cautiously optimistic — a recovery from the dip seen in FY25, but dependent on the delivery of projects and predictable policy support.